With historically thin margins, the Democrats’ legislative and regulatory priorities – such as further COVID-19 relief, the Protecting the Right to Organize Act, efforts to make tax-related changes, and an investment in America’s crumbling infrastructure – will remain a challenge to achieve, with the partisan battle lines, highlighted below, already drawn.

COVID-19 Recovery:

Discussions at the end of the 116th Congress produced a targeted COVID-19 relief package roughly totaling $900 billion centered around several merit shop construction industry-supported small business items, including additional funding for PPP loans, full deductibility of PPP loans, expansion of PPP loans to 501(c)6 organizations, and extension and expansion of the employee retention tax credit. The package also included additional appropriations for COVID-19 related priorities such as testing and vaccine distribution.

This package providse the industry’s small businesses with much-needed aid, as throughout the existence of the PPP, the construction industry received roughly 12% of loans, totaling more than $65 million in relief – the third highest of any sector. Notably missing, however, are liability protections for businesses operating through the pandemic.

As the economy continues to recover in some areas, the construction industry’s backlog continues to shrink, as many new projects have been significantly affected by the pandemic. With most states considering construction to be essential, however, the industry is ready to help lead the way to preserve jobs thanks in part to the significant pre-existing backlog.

As Biden has promised to pursue various workplace safety issues related to COVID-19, such as establishing an OSHA temporary emergency standard for COVID-19, his agencies will likely reverse many of President Trump’s deregulatory accomplishments.

Labor Law:

Biden’s “Strengthening Worker Organizing, Collective Bargaining and Unions” agenda is filled with anti-free enterprise that have been opposed by workers, small businesses, and large firms in the merit shop construction industry. Biden’s labor law agenda is centered around achieving the policy goals of the big-labor-lauded Protecting the Right to Organize (PRO) Act. This legislation, which passed the Democratic-controlled House in 2020, would strip away workers’ free choice in union elections by instituting backdoor card check, codify an Obama-era joint-employer standard, limit independent contractors’ rights by codifying California’s “ABC” test, eliminate right-to-work protections across the country, and roll back many other products of the Trump administration’s Department of Labor.

A Democratic-controlled Senate is poised to attempt to advance the PRO Act that was previously blocked by their Republican counterparts in the 116th Congress. Should the legislation ultimately be passed in Congress, the legislative filibuster would likely have to be removed in the U.S. Senate, which would require significant political capital to achieve.

Regardless of the PRO Act’s fate, the Biden Administration will look to implement as many of the PRO Act’s provisions as possible through the agency rule making process.

The Biden administration’s stance on labor policy is also expected to significantly depart from their predecessors. How different of an approach though, will hinge on the leanings of Biden’s Secretary of Labor nominee Boston Mayor Marty Walsh, who spent decades as a union member and leader, most recently as head of Boston’s Building and Construction Trades Council. Walsh’s hand will guide many of the merit shop construction industry-relevant rules and regulations while he serves in the Frances Perkins building.

Taxes:

As is the case with several other issues, the likelihood that the Biden Administration would be able to make significant tax-related changes greatly hinges on the possible repeal of the legislative filibuster, as a 50 vote Republican Senate minority is not inclined to support the proposed tax increases. If the agenda listed below is to pass into law, Democrats could also resort to the budget reconciliation process to get a tax increase of any kind over the finish line, as was the case for the Republican tax cuts in 2017.

Among many more minor proposed changes to the tax code, President Biden is expected to attempt the following tax changes:

Among many more minor proposed changes to the tax code, President Biden is expected to attempt the following tax changes:

• Return to a top individual tax rate of 39.6% at the $400,000 bracket threshold compared to the highest current rate of 37% established starting in 2018 under the Tax Cuts and Jobs Act.

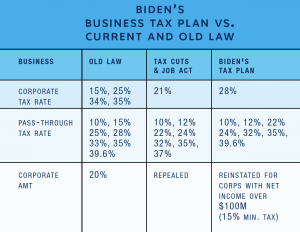

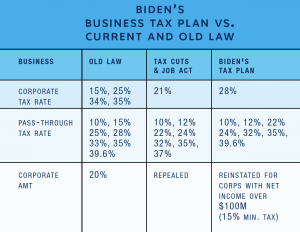

• Increase the C-Corporation income tax rate to 28% from a flat 21% under the Tax Cuts and Jobs Act, which reduced the Obama-era rates from a graduated high of 35%.

• For corporations with at least $100 million in annual income, impose a new 15% alternative minimum tax on reported book income (versus the income reported on corporate tax returns).

Should the plan be signed into law, although it is unlikely all together, contractors will have to decide, with their financial advisers, how they will factor in the effects of the plan into their strategy.

Infrastructure:

The one item of political consensus in an era of partisanship is that an infrastructure investment is needed—and has been for some time. The American Society of Civil Engineers gives the existing United States infrastructure a D+ grade, which is the same mark it received in 2013, while also noting the need to spend $4.5 trillion by 2025 in order to improve the state of the country’s roads, bridges, dams, airports, schools, etc. However, delivering on a substantial infrastructure investment has proved to be elusive for Washington lawmakers. With user-generated revenue streams taking historic losses, in addition to state and municipal budgets facing unprecedented demands, Congress has decided, at least for now, to punt on the issue. However, as was the case for President Trump, the incoming Biden Administration will seek to pass a long-term transformational infrastructure package.

The success of Biden’s $2 trillion “Build Back Better” infrastructure plan, which seeks to pair COVID-19 economic stimulus with an infrastructure investment to include investments in schools, water systems, transit, universal broadband and 5G, will depend on the political will of the administration and Congress. As we learned in 2017 when, President Trump and then-Speaker of the House Paul Ryan decided to prioritize much-needed tax reform, any hope for an infrastructure initiative died as the ensuing battle faded into election year-politics.

However, with COVID-19 relief still needed at the state and local level, a “shot clock” set on a one-year extension of highway funding to expire in September, and an expectedly eager Department of Transportation and Labor, infrastructure advocates remain cautiously optimistic. The details of Biden’s plan are still yet to be seen; however, Congressional Democrats showed their hand when they passed an infrastructure plan dubbed H.R. 2, the Moving Forward Act, that would have spent more than $1.5 trillion on surface transportation, airport, school, housing, healthcare, energy, water and broadband infrastructure. However, the bill excluded many critical priorities for the construction industry while implementing numerous anti-merit shop provisions, such as government-mandated project labor agreements, inflationary Davis-Bacon prevailing wage requirements, and the Obama-era contractor blacklisting rule.

Touted as one of one of the Biden administration’s priority issues, passing a comprehensive infrastructure package will have a short window for a bipartisan infrastructure compromise. However, with the emergence of a Democratic controlled Senate, the appetite for direct federal spending will remain in vouge. Biden’s pick to lead his infrastructure efforts, former South Bend mayor and presidential candidate, Pete Buttigieg, will likely face an uphill battle in unfamiliar waters in Washington. Buttigieg beat out other high-profile potential picks for the DOT post, including the Building Trades Unions preferred choice, former DOT Deputy Secretary John Porcari.

While it is unclear exactly where Butigieg stands on merit shop contractor priorities that are germane to an infrastructure investment like Project Labor Agreements, ABC expects theBiden administration to expand PLA requirements. The President has stated his support for the Obama executive order that mandates PLAs (that was not rescinded under President Trump like it was in the past Republican Administrations) on federal and federally-assisted projects, excluding nonunion bidders from the process.

Among many more minor proposed changes to the tax code, President Biden is expected to attempt the following tax changes:

Among many more minor proposed changes to the tax code, President Biden is expected to attempt the following tax changes: