AVOID COMMON MISTAKES AND COSTLY LITIGATION

By Bob Sanders, Taylor English Duma, LLP

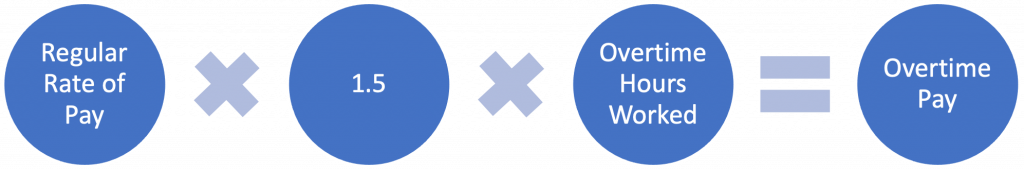

The Fair Labor Standards Act (FLSA) requires employers to pay non-exempt employees overtime at a rate of at least one and one-half times their regular rate for time worked over 40 hours in any work week. That sounds simple, but the devil is in the details.

The “regular rate” is more than just that employee’s hourly rate multiplied by their hours worked. It is critically important to understand what factors into the employee’s “regular rate” and pay overtime correctly. Why? Because class action lawyers are pouncing on even the smallest mistakes to drive up big claims.

This post aims to help you understand how to calculate your employee’s regular rate and overtime then addresses frequently asked questions to help your company avoid mistakes and expensive litigation.

Calculating Overtime

As noted above, the FLSA requires employers to pay overtime compensation at a rate of at least one and one-half times the employee’s regular rate for all hours worked over 40 in any workweek.

“Workweek”

A workweek is a period of 168 hours during 7 consecutive 24-hour periods. It’s up to employers on what day/hour they want to start their workweek, but it must remain consistent once set. Most employers include their workweek definition right in their employee handbook:

Example:

“BobLobLaw Law Office’s workweek begins on Monday at 12 a.m. and ends on Sunday at 11:59 p.m.”

“Regular Rate”

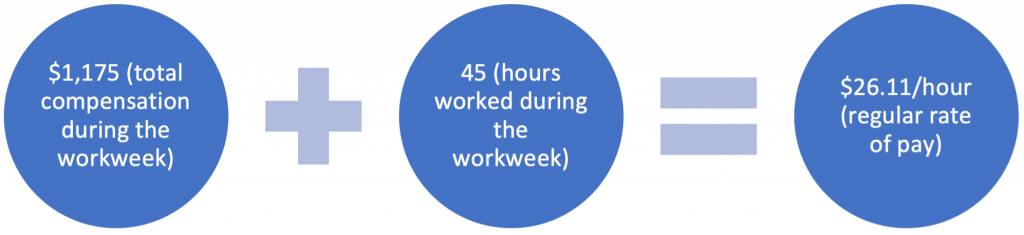

The regular rate is the hourly rate of pay when factoring in all compensation earned during a given workweek, subject to limited exceptions. This may be different than the employee’s hourly rate.

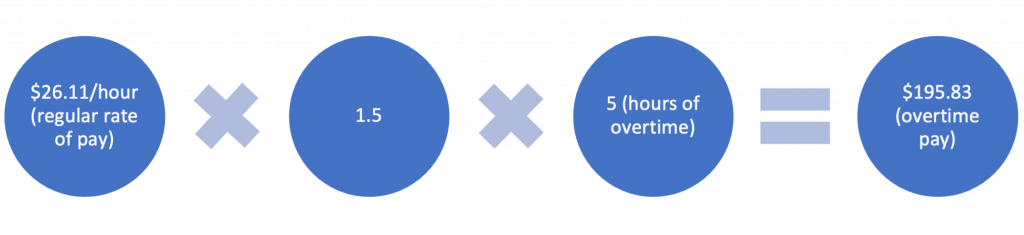

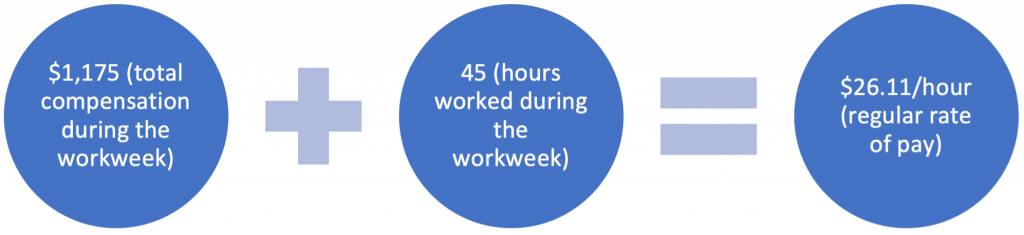

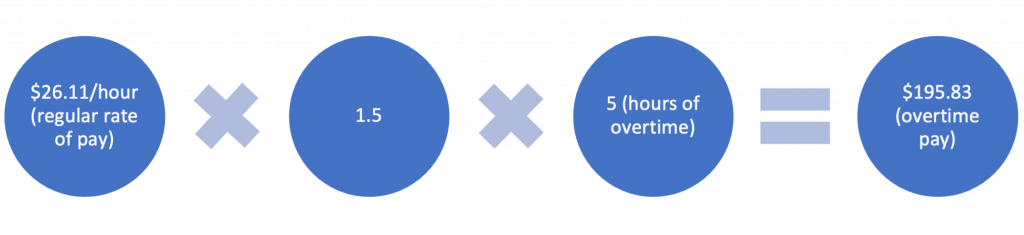

For example, an employee who works 45 hours during a workweek, earning $15 per hour and a $500 productivity bonus has an “hourly rate” of $15 per hour, but a “regular rate” of $26.11 per hour. The employee would earn $112.50 for the overtime hours if the employer incorrectly used the hourly rate versus $195.83 for the overtime hours when using the correct regular rate. Take a look:

Exclusions from the Regular Rate

Fortunately, not all compensation should be included in the regular rate. Certain payments may be excluded from the regular rate IF they meet statutory requirements. In general, these are payments that are not made as compensation for hours of work:

- Gifts

- Vacation pay, holiday pay, sick pay

- Reimbursement for business expenses

- Discretionary bonuses

- Payments to a bona fide profit-sharing or trust or a bona fide thrift or savings plan

- Irrevocable contributions to employee health and welfare plans

- Talent fees paid to performers

- Certain premium pay

- Certain stock options, appreciation rights, and purchase programs

IMPORTANT: Discretionary bonuses can be excluded from the regular rate. Most non-discretionary bonuses cannot. Whether a bonus is discretionary or non-discretionary is not determined by the label a company assigns. It is a FACT-SPECIFIC analysis. If you have questions about whether your company’s bonuses are discretionary or non-discretionary, and whether or not they ought to be included in your employee’s regular rate of pay for overtime purposes, contact an attorney.

Can a company have different workweeks depending on position, location, or other factors?

Yes, companies are permitted to have more than one workweek under the FLSA and the workweek can be different for different groups, locations, or even a few particular employees. There should be a good, non-discriminatory business reason for it – such as varying work patterns or tendencies.

Can a company change its designated workweek?

Likely yes, however, it should not be done frequently or in a way that establishes a pattern of avoiding overtime.

Can a company that uses a bi-weekly pay period calculate overtime based on working over 80 hours during the pay period instead of 40 hours per week?

No. Overtime must be calculated for each workweek, which as noted above is a period of 168 hours during 7 consecutive 24-hour periods (i.e. 7 days).

If an employee works unapproved overtime, is the company still required to pay the employee for those hours?

YES! Employers are required to pay for all time worked, even if it is unapproved. Employers who require overtime to be approved should make sure they are taking steps to oversee and manage their employees schedules, making sure that work is not performed if the employer does not want it to be performed. Once the time is worked, it must be paid.

Can a company and its employee agree to waive overtime regulations?

No. Waiving an employee’s right to overtime is prohibited under both state and federal law. Employers should never ask their employees to waive overtime or permit them to work while “off the clock”.

What’s the big deal?

In our example above, the difference in overtime pay using the incorrect rate versus the correct regular rate is only $83.33. On its own, that is a relatively small amount. However, if that employer has 100 employees who all earn about the same $15/hour plus productivity bonuses and average 30 weeks of overtime per year, and that employer does not correct its pay practices, it may soon face a class or collective action lawsuit demanding three years of unpaid overtime for those 100 employees, or about $750,000. So, it is a problem worth fixing.

Is my company compliant?

That is the right question to ask! Here are some strategies to confirm your compliance:

- Identify all forms of compensation paid to your employees (or on their behalf), including:

- all monetary benefits (salary, wages, bonuses)

- the value of non-monetary benefits such as food and lodging

- equitable compensation such as stock options

- employer contributions to employee benefit plans

- Determine which forms of compensation must be included in the regular rate and whether any meet the statutory requirements for exclusion from the regular rate

- Evaluate whether any per diems or allowances paid to employees to cover expenses are a reasonable approximation of the travel and other intended expenses, or if they could be considered excessive

- Confirm that per diem payments are not based on hours worked. If a per diem is based on and varies with the number of hours worked, the entire amount must be included in the employee’s regular rate.

- Review any discretionary bonuses and determine if they meet the appropriate legal standards to truly be considered discretionary. Confirm that employee handbooks, agreements, and contracts are consistent in how they describe discretionary bonuses.

- Never manipulate hours or pay structures to avoid the FLSA’s regular rate requirements (for instance, do not designate a portion of an employee’s compensation as a “reimbursement”)

- Do not assume your third-party pay vendor is doing it correctly. Confirm and understand how they are calculating the regular rate and that they are including all the forms of compensation your company pays its employees.

- When in doubt: “talk to Bob”. I’ll help you.

Bob Sanders is a partner at Taylor English Duma LLP. He helps companies across the country make confident, business-minded employment decisions. He routinely counsels employers on best practices to avoid risk when handling employee discipline and discharge, leave and accommodation, discrimination and harassment, wage and hour, worker safety, and other issues. He can be reached at rsanders@taylorenglish.com. These materials are informational in nature, are not legal advice, and do not create an attorney-client relationship.